Commodity Credit vs Circulation Credit

Mainstream FIAT economists think a Bitcoin or Gold standard isn't friendly for business because they assume the limited supply will suffocate credit creation. However, not all credit is equal, there’s Commodity Credit and Circulation Credit.

Mainstream FIAT economists think a Bitcoin or Gold standard isn't friendly for business because they assume the limited supply will suffocate credit creation. However, not all credit is equal, there’s Commodity Credit and Circulation Credit.

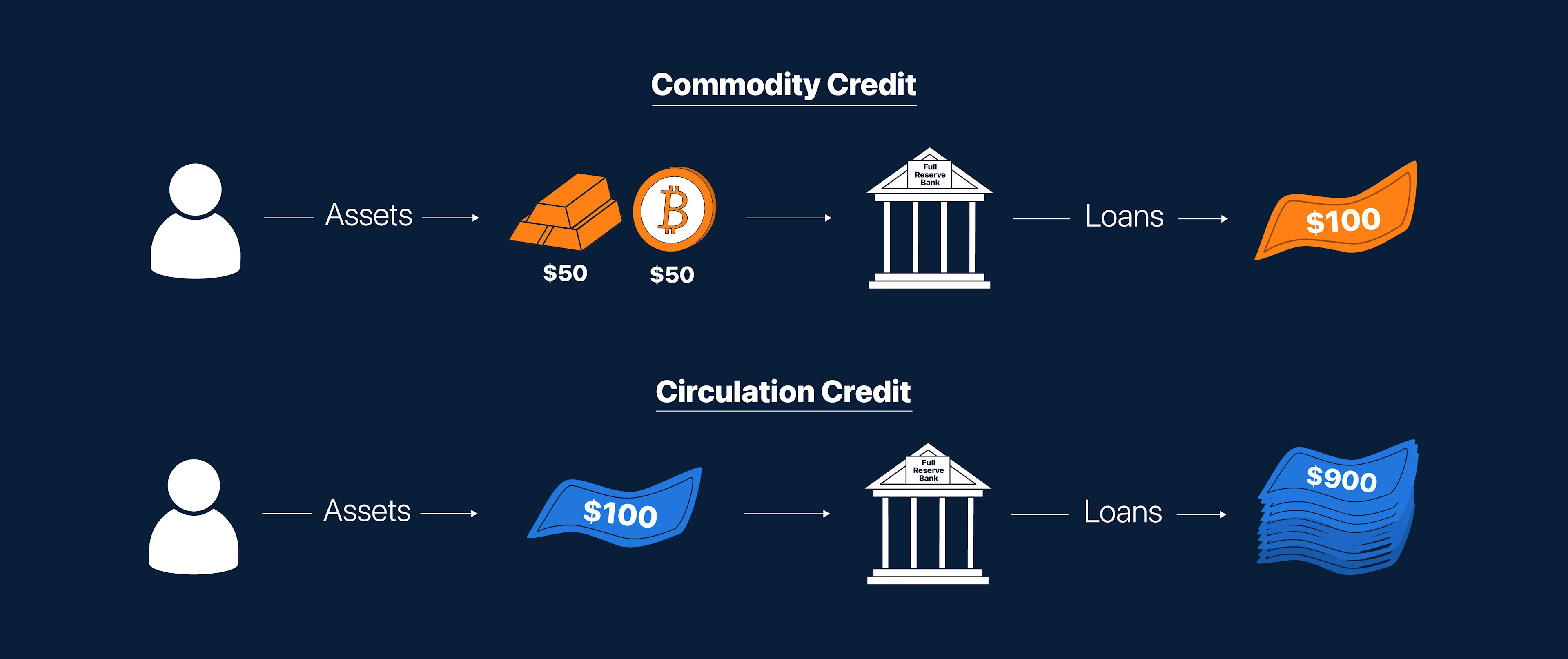

Commodity credit refers to credit backed by savings and permissible under a “full reserve” system or “gold/bitcoin standard” where banks lend out their own funds or the funds entrusted to them by depositors. In contrast, circulation credit permissible in a fractional reserve system where the same capital is lent multiple times is not supported by any saving. It is just a paper claim created by banks.

The absence of commodity-backing credit leads to ever-expanding circulation credit not backed by tangible assets. Banks can lend $100 worth of deposits 9 times, creating $900 of circulation credit. The data speaks for itself: Since the U.S. abandoned the gold standard in 1971, M1 and M2 have grown exponentially (ways measure the supply of money), and U.S. debt has gone from less than $1 trillion to over $31 trillion today.

While circulation credit has played a significant role in driving growth and innovation over the past century, it has also removed all checks and balances on lending across banks, central banks, and the Federal Reserve. As a result, we now have an interventionist market where the Federal Reserve controls the money supply and interest rates (erratically) instead of the free market.

In a free market, interest rates (the cost of capital) are determined by the supply of lenders (people who want to lend their money for a return) and the demand of borrowers (people who want to spend more than they make and are willing to pay a specific price to borrow more money for a period of time). As opposed to today, where interest rates are determined by the Fed.

In addition, circulation credit expansion comes at the expense of savers through currency debasement. In a 1967 paper, former Federal Reserve chairman Alan Greenspan wrote “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.” It's worth noting that under the gold standard pre-1920s, there was only one recorded hyperinflation event (During the french revolution), while in the fiat standard since 1920, there have been over 55 hyperinflation events.

Returning to a gold standard in the digital age isn’t feasible. Bitcoin however is the digital version of gold and has all the qualities that make gold a desirable store of value, but it is infinitely divisible and can travel at the speed of light, which will make it much more usable as a medium of exchange than gold ever was. In a Bitcoin standard, we would have commodity credit and full reserve banking, which will protect the masses from wealth confiscation through inflation.

We have two choices: Circulation credit > fractional reserve banks > interventionist markets or Commodity credit > full reserve banks > free markets. We vote for the latter.