Tokenomics

Tokenomics is a portmanteau of the words Token & Economics.

Tokenomics is a portmanteau of the words Token & Economics. It is a study of how a cryptocurrency (coin or token) operates within the broader ecosystem, mainly revolving around its supply and demand characteristics. Tokenomics is comparable to the supply data issuance of a currency in traditional finance, which is usually reported as M1, M2, M3, or M4 money supply. These data points help to monitor and provide transparency on the different aspects of the supply and demand of a currency. Tokenomics are an important aspect for investors to consider because projects with smart and well-designed Tokenomics are more likely to attract huge investors and survive over the long term.

Core features of Tokenomics

As all fiat currencies are different, similarly, each cryptocurrency is designed with its unique Tokenomics, and the structure of the Tokenomics will determine the incentives that encourage investors to buy and hold the cryptocurrency.

Tokenomics serve two main purposes; firstly, it elaborates on the distribution and allocation of cryptocurrency. Secondly, it sets out the supply and demand mechanisms of the cryptocurrency. Below is a list of variables considered under Tokenomics.

Supply & Demand:

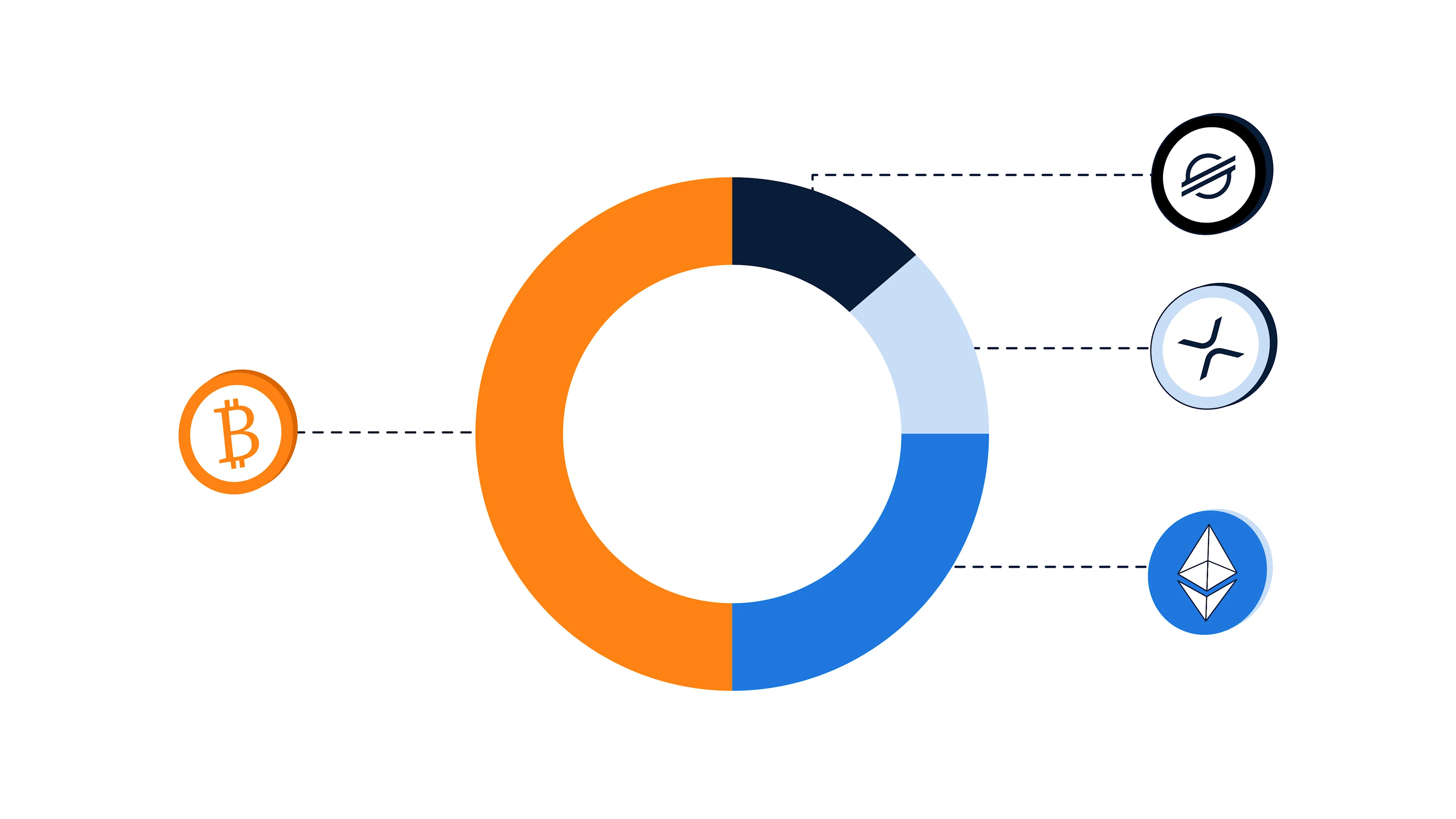

Market Capitalization and supply: The total market capitalization of a cryptocurrency is important to consider against its total supply. This provides an insight into the future price potential and a broader perspective of a cryptocurrency in comparison to the rest of the market. For example, a meme-coin like doge-coin is valued at (the price) $0.2, and its market capitalization stands at $500 billion. If the target price of an investor (speculator) is $1, this would mean that its market capitalization needs to grow 5x its current value, which puts it at $2.5 trillion. In relation to the rest of the market, Bitcoin (the biggest cryptocurrency by market capitalization) does not hold this market capitalization; thus, it becomes clear that achieving a $1 price is almost impossible. This is why it is important to consider market capitalization rather than the price of a cryptocurrency while thinking about the potential percentage increase rather than the dollar increase as an investor. Additionally, it is also important to consider the fully diluted market capitalization since not all the coins or tokens would have been mined; obviously, this is much harder to determine with a cryptocurrency that has an unlimited supply.

Limited or Unlimited: Tokenomics dictates a token's total supply. The supply can be limited or unlimited. For example, Bitcoin has a maximum supply of 21 million coins. Alternatively, Ether (ETH) does not have a maximum supply. A limited supply could mean more value due to scarcity. Additionally, it is also important to consider the amount of supply, even if limited. If a cryptocurrency has a supply of 1 billion or 1 trillion (like most meme coins), it is highly inflated; thus, its value may not grow as much.

Inflation: Some cryptocurrencies have their full supply mined when the project is launched, while others have a mining mechanism that gradually increases the supply. The newly issued supply is usually given as a reward to miners or stakers. For example, the Bitcoin mining schedule (inflation rate) provides a reward to miners for every block mined, which takes about 10 minutes. The reward reduces by 50% for every 210,000 blocks mined (takes about four years). It is important to pay attention to the inflation rate because a high inflation rate could crash the price of a cryptocurrency and, inevitably, the project.

Token burn (deflation rate): Some cryptocurrencies have a “token burn,” which is comparable to share buybacks in traditional finance. This mechanism reduces the supply of the token, which could boost its value if demand stays the same or increases. For example, the implementation of EIP-1559 to Ether has introduced a burning mechanism that makes Ether deflationary during times of high network activity.

Price & value of tech: The technology behind a cryptocurrency needs to serve a purpose to the community and ensure that it can withstand the test of time. Additionally, a cryptocurrency needs also be created from an economic or business perspective. Essentially, the token needs utility in order to put an intrinsic value on it so that it can attract investors and illustrate the potential for future profit.

Token Distribution and Vesting schedule: Look out for whale holders of a given cryptocurrency because this represents the potential for huge selling pressure. In addition, some projects pre-mine a portion or the full supply of their cryptocurrency. The pre-mined tokens are usually distributed to early investors, which include angel investors, venture capitalists, or developers. Ideally, projects will attach a vesting schedule to this allocation to ensure that the early investors do not sell (dump) too early and crash the price. When looking at the vesting schedule, it is important to consider the unlock periods and how much is unlocked to calculate the potential of fore-coming heavy selling pressure. Moreover, it is important to consider how the cryptocurrency has been distributed or allocated; for example, an investor should consider whether most of the supply has been distributed to private individuals or the community.

Consensus mechanism: The type of consensus mechanism chosen can play a key role in inclusivity. Generally, it requires more resources and expertise to be able to set up a mining rig (PoW) than a staking pool (PoS). If a network can include more people in its network, it has the potential to be more decentralized and, therefore, more secure against a 51% attack or centralized control.

Governance: The developers of a project are behind the critical aspects of a cryptocurrency’s Tokenomics. Although, some developers chose to have a hands-off approach by creating a governance token in addition to a network token, or the cryptocurrency itself may provide rights and responsibilities of governance to the users. This can be regulated by a holding period or the number of tokens held.

Why is Tokenomics important?

Supply and demand will determine the value and market price of an asset, including cryptocurrencies. Tokenomics provides guidance in understanding the potential of a cryptocurrency or project in the future (more especially the price). For example, if there is a huge correlation or cause-link effect between the product and the cryptocurrency, then it would suggest that increased adaptation of the platform will also require the increased adoption of the cryptocurrency, therefore increasing its value (price). Additionally, understanding the Tokenomics of a cryptocurrency can help investors to identify valuable projects from an early stage and invest much earlier to get a higher ROI.

Moreover, being a new asset class, cryptocurrencies are often at a regulatory risk of being deemed a security. Understanding Tokenomics and the regulation of securities can provide a foresight of any regulatory clampdowns. The Ripple lawsuit against the Securities Exchange Commission (SEC) is a good example.