Kalam Crypto #101: Bitcoin ETF Set New Standards For Transparency in Finance

This week, Bitcoin ETFs set a new standard for transparency in finance, BlackRock leading the bitcoin ETF race, Vitalik Buterin visits RAK DAO in the UAE, and Solana's new users surged to a new all-time high.

“It might make sense just to get some in case it catches on.” Satoshi Nakamoto

Ahlan wa sahlan, and welcome to the 101st edition of CoinMENA's weekly newsletter, Kalam Crypto. This week, Bitcoin ETFs set a new standard for transparency in finance, BlackRock leading the bitcoin ETF race, Vitalik Buterin visits RAK DAO in the UAE, and Solana's new users surged to a new all-time high. All that and more on this week’s Kalam Crypto.

Prefer to listen to Kalam Crypto instead? Check out our podcast:

Global News 🌍

Bitcoin ETF setting a new standard for transparency in finance: For the first time in the history of traditional finance, anyone, anywhere in the world, can go online and witness, in real time, the exact quantity of an asset held by a specific company. Bitwise’s Bitcoin ETF (BITB) has become the first U.S. bitcoin ETF to disclose its bitcoin addresses, allowing you to explore the holdings yourself. Click the link and see for yourself. At the time of writing this newsletter, BITB has amassed 12,840 BTC, worth approximately 550 million dollars.

Solana is experiencing a surge in new addresses, reaching its highest-ever 7-day moving average: The uptick is attributed to the airdrop of the new memecoin, WEN, to over one million wallets. Launched by Jupiter, Solana's largest decentralized exchange aggregator, users have until tomorrow to claim WEN. As the best-performing altcoin of 2023, Solana continues its momentum into 2024, marked by record transaction volumes and an all-time high in daily new addresses. January 2024 has already surpassed December 2023 in overall signup count, with over 10 million new addresses.

Keep an eye on 👀

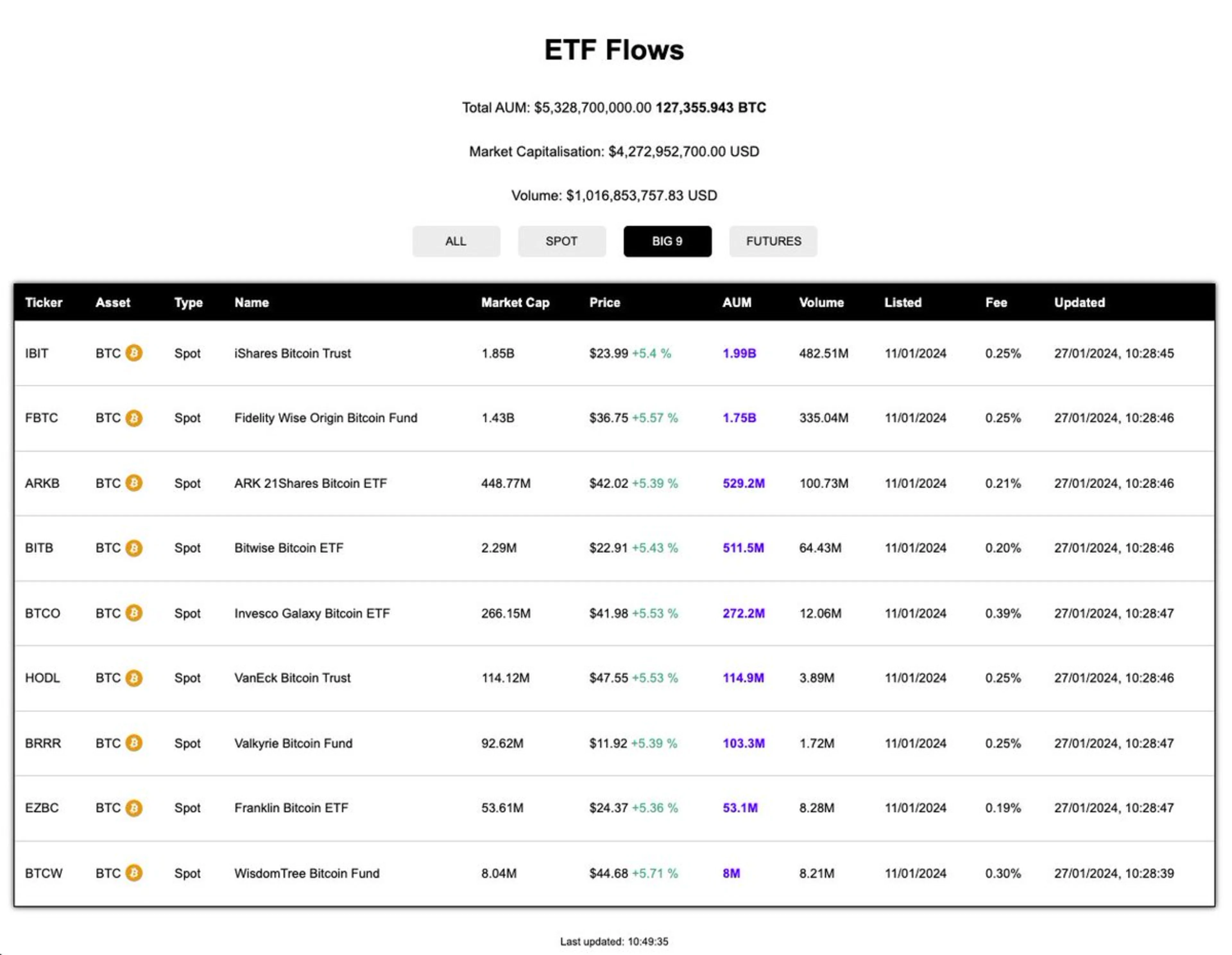

The ETF stacking race: In just two weeks, spot bitcoin ETFs have amassed 5.3 billion dollars worth of bitcoin. BlackRock’s bitcoin ETF is leading the way so far with $1.8 billion and Fidelity with $1.4 billion. The inflows have not been enough to push the price of bitcoin back above the pre-ETF launch, mainly due to large outflows from the Grayscale Bitcoin Trust.

Local News 📍

The First Bitcoin Only Conference in Dubai: Bitcoin Oasis Dubai (February 8-9, 2024): For the first time, an intimate circle of global leaders of the bitcoin industry, private sector, and governmental bodies will get together in Dubai to discuss the transformative potential of bitcoin. Space is limited, so attendees will need to apply through the event’s website to book their spots. If you consider yourself a bitcoiner, this is an event you don’t want to miss!

Blog of The Week ✍️

Check out our latest report from our partnership with Onramp Bitcoin titled “Increasing Scarcity: Bitcoin's Value Appreciation”. You can download the full PDF here or from our blog website.

CoinMENA News 🗞️

🏆1,000 USD Referral Competition: The user with the highest number of successful referrals (invited who verify their accounts) will win the $1,000 prize! Here's how it works:

📤Share Your Link: Invite your friends, family, and colleagues to join CoinMENA using your unique referral link.

✅Verification Bonus: Both you and your invited friend will earn $5 each when they successfully verify their account.

🏆Top Referrer Prize: The user with the highest number of successful referrals (invited who verify their accounts) will receive a $1,000 prize!

This competition ends tomorrow. Good luck!

Tweet Of The Week 🐥

Quiz Corner ✅

Last week’s question: What makes direct bitcoin ownership better than investing in a Bitcoin ETF?

The correct answer is D) All the above

According to our latest report from our partnership with Onramp Bitcoin titled “Increasing Scarcity: Bitcoin's Value Appreciation”, how does the limited supply of 21 million Bitcoins contribute to Bitcoin's growth engine?

A) It ensures that Bitcoin will always remain cheap.

B) It creates scarcity, driving up demand and value.

C) It limits the number of transactions that can occur.

D) It has no impact on Bitcoin's growth.

Correct Answer: B) It creates scarcity, driving up demand and value.

See the answer in next week’s newsletter. Or check out our new learning platform https://university.coinmena.com/