Kalam Crypto #155: UAE’s Crypto Framework, Trump’s 401(k) Plan & More

This week, we’re covering exciting moves in crypto regulation in the UAE, and Trump’s plan to bring crypto into US retirement accounts.

“The best way to predict the future is to invent it.” — Alan Kay

Ahlan wa sahlan! Welcome to the latest edition of Kalam Crypto, your trusted source for crisp, insightful updates on everything crypto across the globe and the MENA region. This week, we’re covering exciting moves in crypto regulation in the UAE, and Trump’s plan to bring crypto into US retirement accounts. All this and more in this week’s Kalam Crypto! Let’s dive in👇

Local News 📍

UAE Unifies Virtual Asset Regulation

The UAE Securities and Commodities Authority (SCA) and Dubai’s Virtual Assets Regulatory Authority (VARA) have signed an agreement to create a unified framework for regulating virtual assets nationwide. The partnership streamlines licensing, supervision, and legislative coordination, ensuring consistent rules across all emirates. It aims to boost transparency, speed up approvals, and enhance investor protection, solidifying the UAE’s position as one of the world’s most active digital asset markets.

CoinMENA welcomes this milestone, which supports responsible innovation and strengthens market confidence.

Global News 🌍

Trump to Allow Crypto in US 401(k) Plans

US President Donald Trump has signed an executive order to make it easier for Americans to invest their retirement savings in cryptocurrencies. The order directs the Labor Department to review restrictions on alternative assets, coordinating with the Treasury and SEC on potential rule changes. This move could help bring more clarity and opportunities to the $12.5 trillion retirement market. At CoinMENA, we’re excited to see steps that open new doors for everyday investors to include crypto in their long-term savings and grow with confidence.

MicroStrategy Buys $18M in Bitcoin to Celebrate 5 Years

Michael Saylor’s MicroStrategy marked its fifth anniversary of buying Bitcoin by adding another $18 million worth of Bitcoin (155 BTC) last week. That brings their total to nearly 629,000 BTC bought over five years, starting with a $250 million purchase back in 2020. Despite the smaller recent buy, Saylor’s commitment to steadily accumulating Bitcoin remains strong!

Vitalik Buterin Becomes Onchain Billionaire Again

According to a blockchain intelligence firm, Arkham, Ethereum co-founder Vitalik Buterin reclaimed his “onchain billionaire” status as Ether topped $4,200 for the first time in months. His portfolio is now worth about $1.04 billion, holding 240,000+ ETH. Traders are optimistic Ether could soon challenge its all-time highs, boosted by strong inflows into Ether ETFs and growing market momentum.

UK’s Union Jack Oil to Turn Stranded Gas into Bitcoin

UK energy company Union Jack Oil plans to use natural gas from its West Newton site to power Bitcoin mining rigs. This smart move could create early cash flow from wells stuck due to delays and might lead to one of the UK’s first corporate Bitcoin treasuries. Partnering with specialists, they aim to mine Bitcoin right on-site, skipping traditional infrastructure hurdles and turning stranded gas into profit.

Keep an eye on 👀

Ether ETFs See Record $1B Inflows

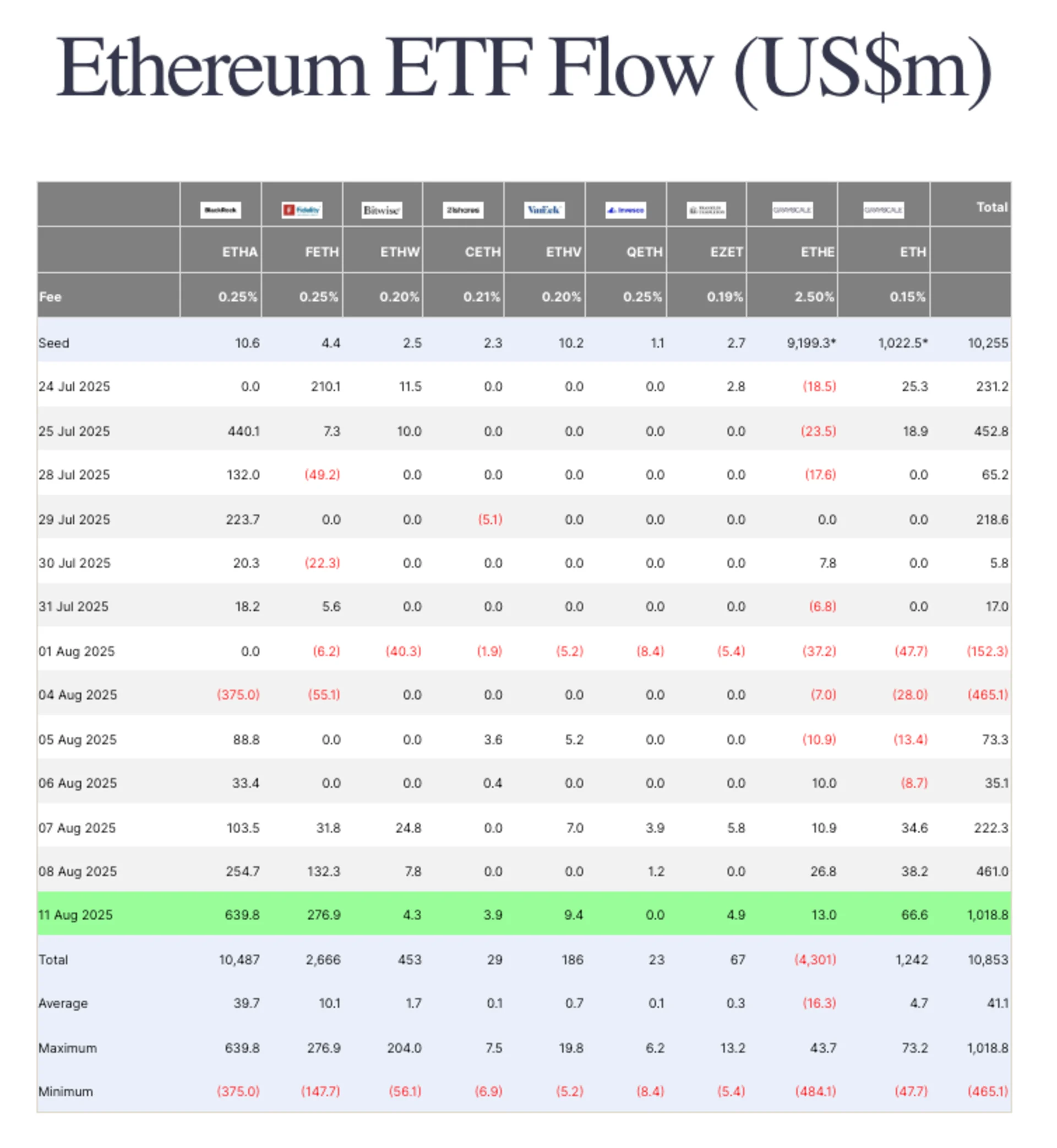

Spot Ether ETFs saw their biggest net inflow day ever, attracting $1.01 billion—far surpassing Bitcoin ETFs’ $178 million. BlackRock’s ETHA led with $640 million, followed by Fidelity’s FETH with $277 million. The surge comes as ETH trades around $4,301, up 45% in the past month, with Ether held on exchanges hitting a nine-year low and over $150 billion staked according to data from Glassnode. Ether ETFs have bought over 50% of all ETH issued since the Merge in late 2022—signs of strong institutional confidence in Ethereum’s future.

Source: Farside Investors

Post Of The Week 🐥

Blue Origin Now Accepts Crypto for Space Trips

Jeff Bezos’s Blue Origin now lets you buy space trip tickets using Bitcoin, Ether, Solana, and stablecoins like USDt and USDC, paying directly from wallets like MetaMask or Coinbase. This is part of a fun trend mixing crypto with space — think NFTs launched into orbit and satellites running blockchain networks. Fun fact: Tron’s founder Justin Sun paid $28 million for a ride on Blue Origin!

CoinMENA News 🗞️

We’re thrilled to share that Dina Sam’an, Founder & Managing Director of CoinMENA, has joined Ignyte’s global mentor network! As a leading fintech innovator in the Middle East, Dina will now mentor founders worldwide, sharing her expertise in regulation, market expansion, and building resilient digital finance ecosystems. Her insights and leadership are set to inspire the next wave of entrepreneurs!

New Travel Rule Automation and Exclusive Offers are Here!

As part of our commitment to regulatory excellence, CoinMENA has integrated Travel Rule automation with Ospree to make your transactions safer and smoother.

To celebrate our recent app revamp, we’re bringing back popular limited-time offers for verified users—earn when you trade or invite friends! Open the app today to unlock these special perks and experience next-level crypto trading.

Quiz Corner ✅

Last week’s question: What year was the Ethereum network officially launched? The correct answer is: 2015

This week’s question is: What is the main goal of the new agreement between the UAE’s SCA and VARA regulators?

A) To ban virtual asset trading across the UAE

B) To create a unified licensing and supervision framework for crypto firms

C) To increase taxes on cryptocurrency transactions

D) To replace all crypto regulations with a federal law

See the answer in next week’s newsletter. Or check out our learning platform https://university.coinmena.com/

Invest in the future of finance today with CoinMENA

Related Articles

Kalam Crypto #161: CoinMENA Leads the Way in Women Empowerment & Crypto

Kalam Crypto #160: From the UK to Dubai – This Week’s Top Crypto Highlights

Kalam Crypto #159: Global Moves, Market Highlights & New Assets