Kalam Crypto #117: UAE approves licensing scheme for AED stablecoins

This week, the UAE approved a new licensing scheme for AED stablecoins, fintech giant Robinhood to acquire crypto exchange Bitstamp, and BlackRock BTC holdings surpass 300,000!

"Bitcoin is a Trojan horse for freedom." - Alex Gladstein

Ahlan wa sahlan, and welcome to the 117th edition of CoinMENA's weekly newsletter, Kalam Crypto. This week, the UAE approved a new licensing scheme for AED stablecoins, fintech giant Robinhood to acquire crypto exchange Bitstamp, and BlackRock BTC holdings surpass 300,000! All that and more in this week’s Kalam Crypto.

Prefer to listen to Kalam Crypto instead? Check out our podcast:

Local News 📍

UAE to license Stablecoins: The Central Bank of the United Arab Emirates (CBUAE) has approved a new licensing system for stablecoins. This regulation aims to clarify the issuance, licensing, and supervision of dirham-backed payment tokens, which must be solely backed by UAE dirhams and cannot be linked to other currencies, digital assets or algorithms. This initiative is part of the UAE’s financial infrastructure transformation program to boost digital transactions and foster innovation within the digital economy.

Global News 🌍

Robinhood to acquire crypto exchange Bitstamp: Robinhood announced plans to acquire Bitstamp in a potential $200 million deal aimed at enhancing its cryptocurrency services and expanding its global footprint. This acquisition will allow Robinhood to integrate Bitstamp’s retail customers across the EU, UK, U.S., and Asia, as well as institutional clients, thereby broadening its offerings to a new class of investors. Established in 2011, Bitstamp is the world's oldest crypto exchange, boasting over 50 global licenses and supporting more than 85 tradable assets. Amidst ongoing legal challenges with the SEC, this move underscores Robinhood's commitment to the crypto sector and its anticipation of continued high demand.

Keep an eye on 👀

BlackRock Stacked 300,000 BTC: BlackRock's spot Bitcoin ETF has achieved a significant milestone, surpassing 300,000 BTC in assets under management (AUM). This places the ETF among the top performers in the cryptocurrency market, demonstrating strong investor confidence and substantial inflows. This achievement follows BlackRock's IBIT ETF overtaking the Grayscale Bitcoin Trust (GBTC) in AUM, highlighting a growing interest in spot Bitcoin ETFs. The ETF now manages assets worth over $21 billion, reflecting the increasing acceptance and adoption of Bitcoin in traditional financial markets.

Blog of The Week ✍️

The flight to scarce assets is underway as no one wants to save in an instrument with an infinite supply that can be manipulated on-demand by the Federal Reserve. Check out our CEO Talal Tabbaa’s latest article about the death of U.S. treasuries as a reserve asset.

CoinMENA News 🗞️

$2,000 Prize: Trade & Win: Happy Eid! We’re giving away $2,000 to 10 CoinMENA users who place a trade before June 20th. Ten users will qualify to win $200 each simply by placing a trade!

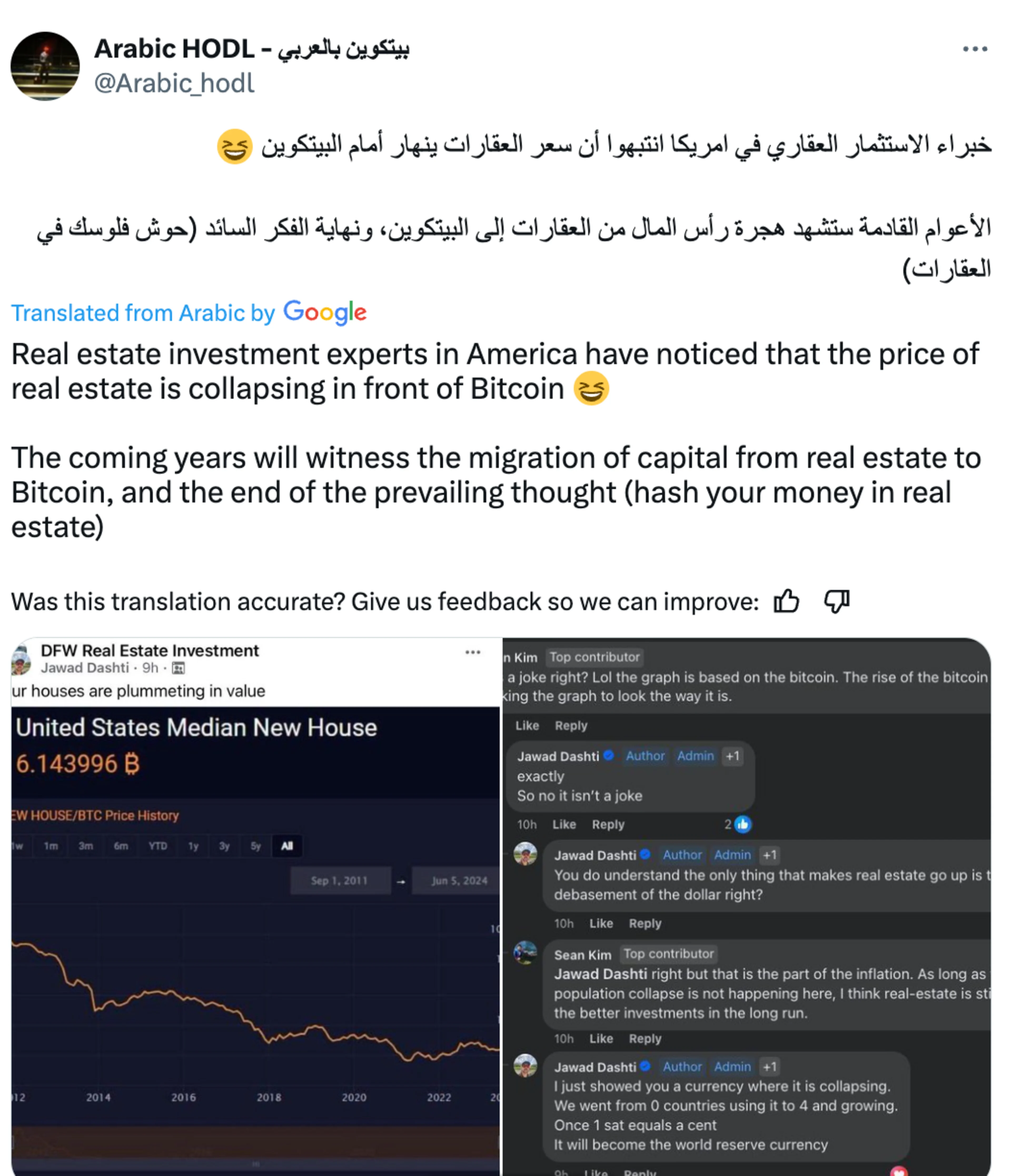

Tweet Of The Week 🐥

Quiz Corner ✅

Last week’s question: what is the most scarce financial asset in the world right now? The correct answer is a) Bitcoin

This week’s question is, how many bitcoins have ETFs amassed since launching in January of this year? Remember, 19.7 of the 21 million bitcoin that will ever exist have already been mined:

Less than 100 thousand

Less than 500 thousand

Less than 1 million

Over 1 million

See the answer in next week’s newsletter. Or check out our new learning platform https://university.coinmena.com/