Kalam Crypto #152: CoinMENA Releases Upgraded App & Bitcoin Hits New ATH

his week, Bitcoin reaches a historic new high, Dubai leads the way in tokenized finance, Washington kicks off Crypto Week with three major bills on the table, and CoinMENA reveals its most significant app upgrade yet.

"The ability to simplify means to eliminate the unnecessary so that the necessary may speak." — Hans Hofmann

Ahlan wa sahlan, and welcome to the 152nd edition of CoinMENA’s weekly newsletter, your trusted source for the latest in crypto from the region and beyond, Kalam Crypto! This week, Bitcoin reaches a historic new high, Dubai leads the way in tokenized finance, Washington kicks off Crypto Week with three major bills on the table, and CoinMENA reveals its most significant app upgrade yet.

All this and more in this week’s Kalam Crypto! Let’s dive in👇

CoinMENA News 🗞️

CoinMENA Upgrade: A Whole Better App Experience

We’re thrilled to announce the release of our upgraded CoinMENA mobile app, redesigned to give you a faster, smarter, and more secure experience. You’ll notice it the moment you open the app: a fresh new look that’s sleek and modern, while keeping the same intuitive design and user-friendliness you’ve come to expect.

Want the full breakdown of what’s new? Read our blog post here, now also accessible directly from the app, or update your app and experience the difference!

Global News 🌍

📈Bitcoin Hits $120K — Now the 5th Largest Asset in the World

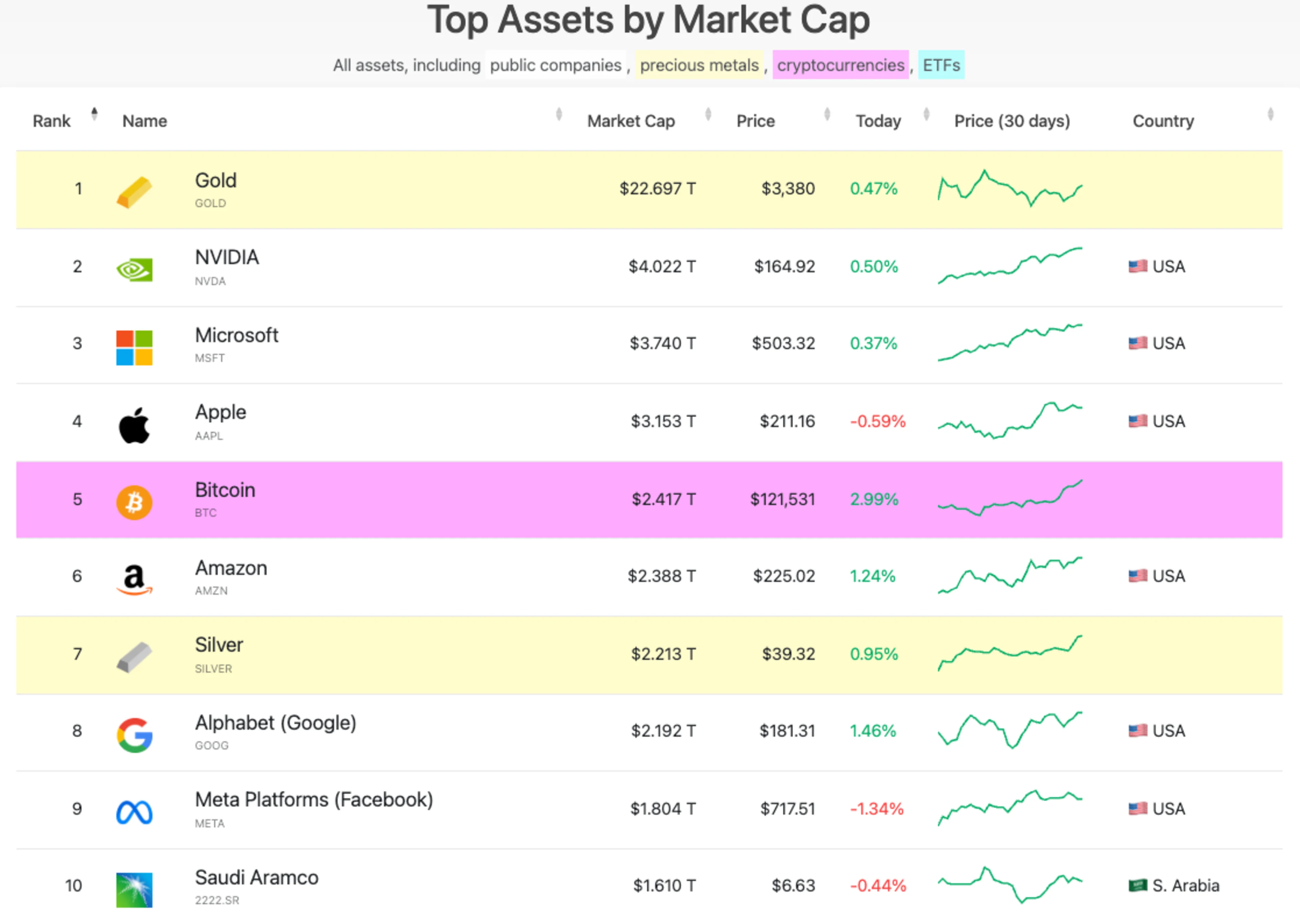

Bitcoin has officially become the world’s fifth-largest asset by market capitalization after breaking through the $120,000 mark. With a total market cap of $2.4 trillion, it now ranks just behind gold, NVIDIA, Microsoft, and Apple, and ahead of Amazon, Silver, and Google.

Metaplanet Buys Another 797 BTC

Japanese investment firm Metaplanet also continued its aggressive Bitcoin strategy by acquiring an additional 797 BTC for $93.6 million. Now the fifth-largest public corporate Bitcoin holder globally, Metaplanet plans to borrow against its BTC to buy revenue-generating businesses. The firm, which pivoted from hotel management to Bitcoin-focused operations last year, aims to hold over 210,000 BTC by 2027. Its Q2 revenue jumped 42% year-over-year, as Bitcoin surged past $120,000 and Metaplanet’s stock rose 1% on Monday.

“Crypto Week” Begins in Washington

U.S. lawmakers are kicking off what they’re calling “Crypto Week”, a concentrated legislative effort to bring long-awaited clarity to digital asset regulation. Three major bills are up for discussion: the CLARITY Act, which seeks to define crypto market structure and shift regulatory oversight from the SEC to the CFTC; the GENIUS Act, which introduces a stablecoin framework with strict 1:1 reserve backing; and the Anti-CBDC Act, aimed at blocking the Federal Reserve from issuing a central bank digital currency.

Whether or not the bills pass this week, the signal is clear: crypto is no longer on the sidelines in Washington.

Local News 📍

Dubai Approves First Tokenized Money Market Fund

The Dubai Financial Services Authority (DFSA) has approved the QCD Money Market Fund (QCDT), making it the first officially licensed tokenized money market fund in the Dubai International Financial Centre (DIFC). This fund, a collaboration between Qatar National Bank (QNB) and DMZ Finance, represents a significant step in the GCC region's development of compliant digital asset frameworks. As the global market for tokenized real-world assets is expected to reach $18.9 trillion by 2033, this move positions the Gulf as a serious contender in the race to modernize financial markets.

While other regions are still debating how to regulate tokenization, Dubai is already setting the pace for compliant innovation. As a VARA-licensed platform, CoinMENA is proud to be part of this regulated ecosystem, working alongside regional partners to build the financial infrastructure of the future.

Keep an eye on 👀

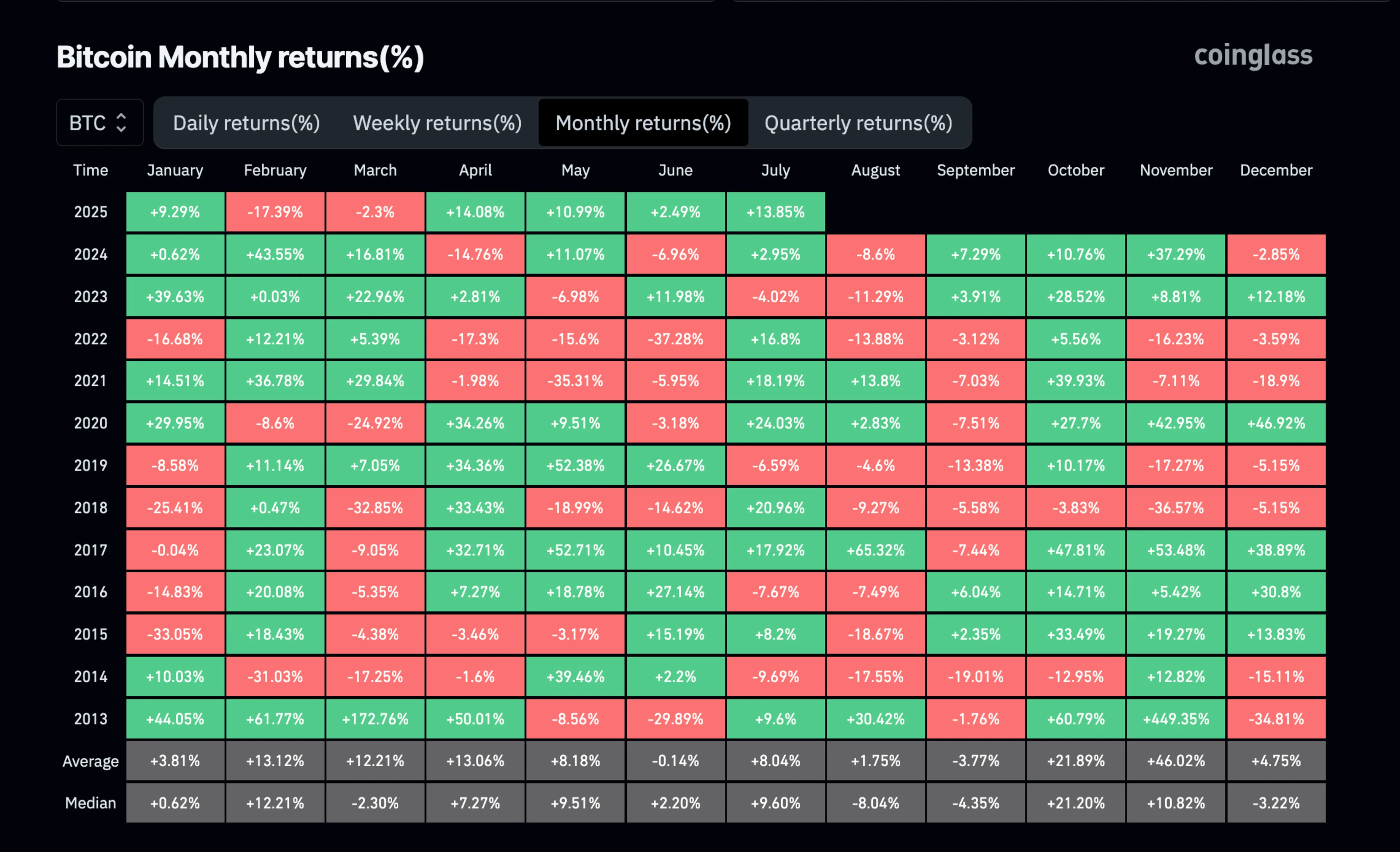

As shown in the BTC monthly returns chart, Bitcoin is off to a strong start in July 🚀

Tweet Of The Week 🐥

“A Bloomberg reporter called gold ‘physical Bitcoin.’”

Bitcoin isn’t the new gold — gold is now being defined in Bitcoin terms. That says everything about how far we've come.

Quiz Corner ✅

Last week’s question: True or false: Tether was the 10th largest buyer of U.S. Treasuries in 2024.

The correct answer is: false, Tether was the seventh-largest buyer of the U.S. Treasuries

This week’s question: As Bitcoin’s market cap surged past $2.4 trillion, it overtook which of the following assets to become the 5th largest in the world?

A) Amazon

B) Google

C) Silver

D) All of the above

See the answer in next week’s newsletter. Or check out our learning platform https://university.coinmena.com/

Invest in the future of finance today with CoinMENA

Related Articles

Kalam Crypto #156: ETH ETFs Explode, Japan Unveils Yen Stablecoin

KC 157: ETH Breaks Record, Stablecoins Take Center Stage, Bitcoin Scarcity Shine

Kalam Crypto #154: Celebrating Ethereum’s Decade & TradFi’s Blockchain Surge